Kent Manderville, retired NHL player and Director of IP Hockey Family Office, walks us through what a million-dollar NHL salary really looks like in the real world.

If I Had A Million Dollars…

In the early 1990’s I played for the St. John’s Maple Leafs and, due to a municipal worker strike in St. John’s, we had to play our home games on the road. The result was a never-ending road trip through the Maritimes from Stephenville to Halifax and all points in between. No one likes to be in the minors when the NHL is so close, and some guys would get a little bitter and sarcastic.

The Barenaked Ladies had a hit song at the time, “If I Had a Million Dollars” and when it was played on the bus during one of our many bus trips that year, guys would chirp in their own words with what they would do with a million dollars. I can’t recall many of the lines but no one said “I’d continue riding the bus through the Maritimes in the American Hockey League”! Everyone wants to be in the NHL, end of story.

The million-dollar mark is a nice, round number that signifies success. The TV gameshow, “Who Wants to be a Millionaire” is another classic example.

Everyone wants to be a millionaire!

Let’s walk through what happens to a player making $1 million in today’s NHL (we’ll use US dollars here):

But wait, there’s taxes…

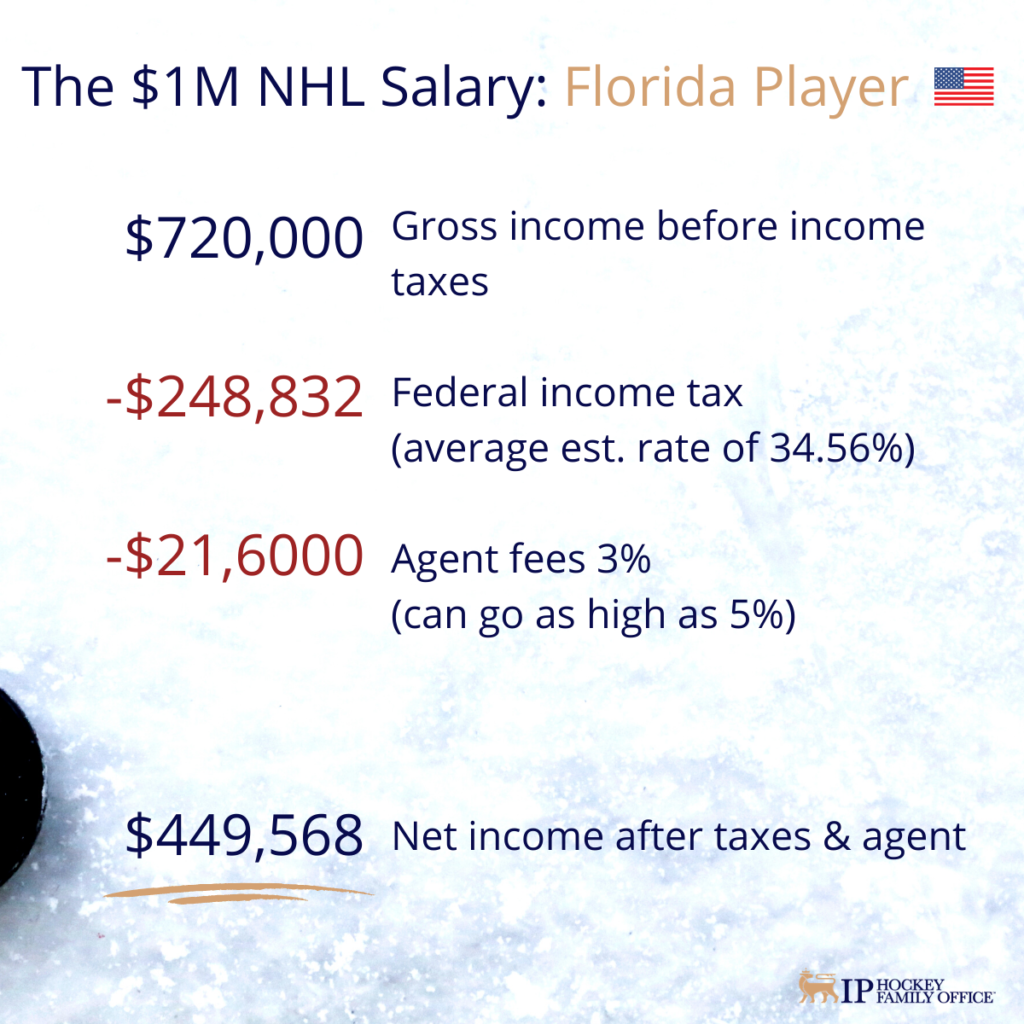

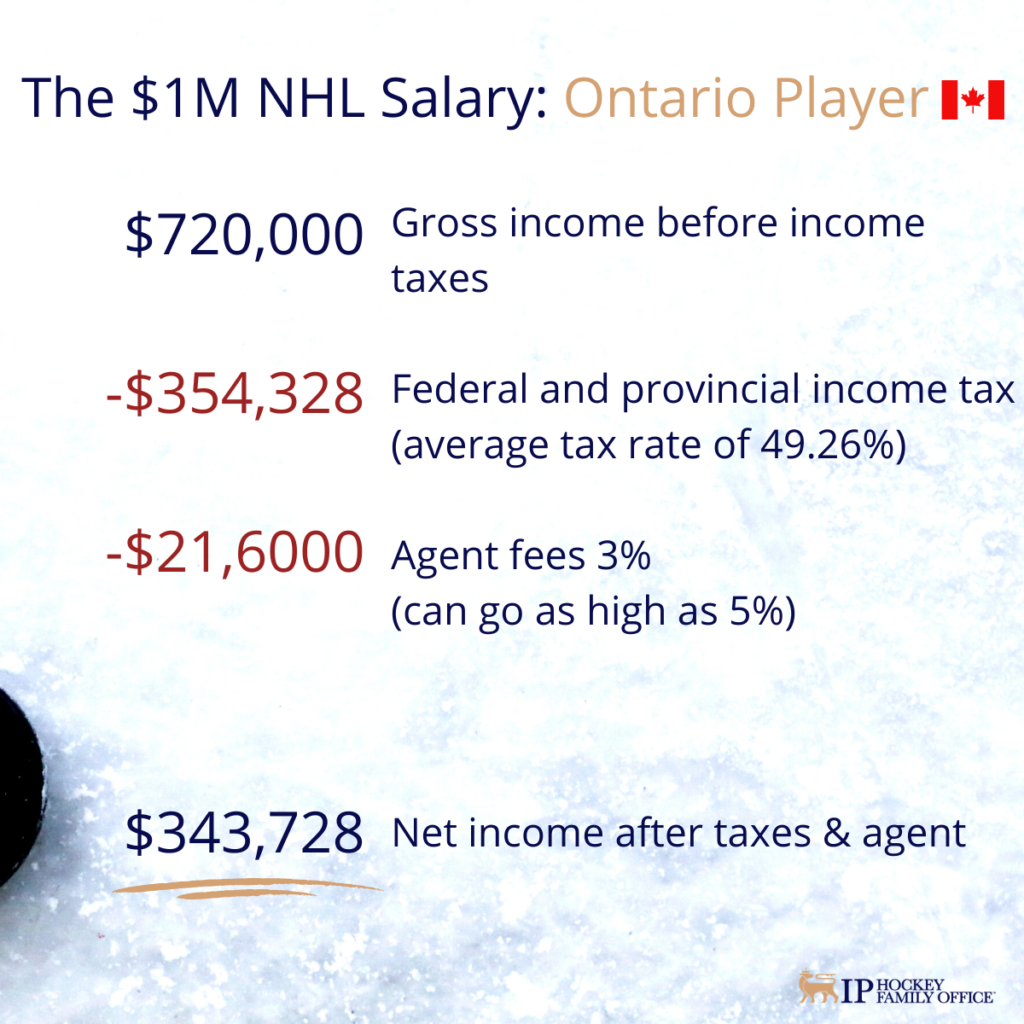

The reality is that income tax rates vary quite a bit around the NHL. Let’s look at two extremes, a player in Florida and a player in Ontario:

While the difference between a player in Florida and Ontario is significant (roughly $100,000 net income difference), all NHL players still have to pay for housing, car, training, and other living/incidental expenses that can easily add up to a significant amount – which obviously lessens the amount that can be used for investing and in their transition from hockey.

A million-dollar salary is great and a fantastic achievement, but NHL players have to realize they only receive a fraction of that amount and they need a plan for how to protect and grow what dollars they do receive. And those dollars need to last a long while in their transition from hockey to their career beyond the rink.

It’s something we never considered when we were riding the bus through the Maritimes singing along to the Barenaked Ladies with our own chirps on what we would do with our million dollars.

What is the IP Hockey Family Office?

IP Hockey Family office is a wealth management firm devoted to the career and financial wellbeing of hockey professionals. Our ‘family office’ model is designed to get all your advisors working collaboratively so that you end up with one clear gameplan. Our director, former NHLer Kent Manderville, ensures that each plan takes into account the unique nature of your hockey career and earnings, ensuring that your personal, athletic, and post-hockey goals are included in your wealth planning process. Learn more here.

All amounts in US dollars and converted to Canadian dollars at a $1.25/$0.80 rate. “The illustration provided herein is for general information purposes and may vary based on each individual’s personal circumstances.