Should I Pay Myself in Salary or Dividends?20211116182741

Should I Pay Myself in Salary or Dividends?

It comes up in every initial meeting we have with a business owner: the question of salary versus dividends. Both are legitimate ways to draw an income from your corporation, but both have their pros and cons. There’s 3 main ways to pay yourself as a business owner. When it comes to paying yourself from […]...

How doctors can protect their income in case of illness20211109215208

How doctors can protect their income in case of illness

You’ve likely invested over 10 years of your life and over $200,000 into your education on your path to becoming a physician—a career that requires your mind and body to be in sound working order. Breaking a couple fingers on a soccer pitch or getting a concussion on an ATV may be moderate inconveniences to the average person, but to a doctor, the wrong injury at the wrong time can end a career....

Giving the Smart Way: Donor Advised Funds20210928162540

Giving the Smart Way: Donor Advised Funds

A Donor Advised Fund is a singular fund for philanthropic giving; it permits donors to make a charitable contribution to their chosen charities via the Fund as frequently as they desire, in increments to each in various proportions depending on the donor’s desire or the charities’ needs....

What does the Custodian do for Me and My Wealth Management Firm?20210921154200

What does the Custodian do for Me and My Wealth Management Firm?

The difference between a custodian and an investment manager is confusing, but these two crucial entities work to grow and protect your wealth....

IP360° Podcast Ep 12: Entrepreneurial lessons from Corinne Bryson, InEx Inc20210720220647

IP360° Podcast Ep 12: Entrepreneurial lessons from Corinne Bryson, InEx Inc

Corinne Bryson is founder and CEO of INEX Inc., a company devoted to creating executor packages and resources that are distributed through funeral homes. Corrine began her entrepreneurship journey 20 years ago and we asked her to join us on the IP360° Podcast to share lessons, stories, and warnings for the next wave of business […]...

Owning a Boat: the pros and cons20210720212429

Owning a Boat: the pros and cons

Like with all investments, there are advantages and disadvantages to becoming the captain of your own ship. It may be a great way to spend more quality time with family and develop new hobbies, but the time commitment and financial outflows are evident concerns. At the end of the day, your respective situation will determine whether this investment is truly worthwhile; we hope this list serves you...

Financial Planning Designations: Who does what, and who do I need?20210720202155

Financial Planning Designations: Who does what, and who do I need?

As if the financial planning and wealth management industry wasn’t already full of jargon, the certifications and designations behind advisors’ names simply add more confusion to the industry. These days there are numerous designations that advisors can get, but they don’t all add up to the same use or value for the client. Here are a few of the most common designations you’ll find in financial ad...

Health Spending Accounts: the benefit plan alternative20210720171339

Health Spending Accounts: the benefit plan alternative

An HSA (also called a Private Health Services Plan) is a method to provide medical, dental and vision benefits in a tax efficient manner; it is Canada Revenue Agency-approved (when constructed properly). A corporation can write off 100% of the costs related to its HSA and all expenses are reimbursed tax-free to the employees ....

Investing 101: What are the various asset classes available to investors?20210520141116

Investing 101: What are the various asset classes available to investors?

When it comes to investing in public markets, most investors are familiar with the three traditional asset classes: Cash and Money Markets, Bonds, and Stocks. But there are other classes that may be overlooked, or that you may forget to discuss with your advisors when you meet to work on your portfolio strategy. Here’s a […]...

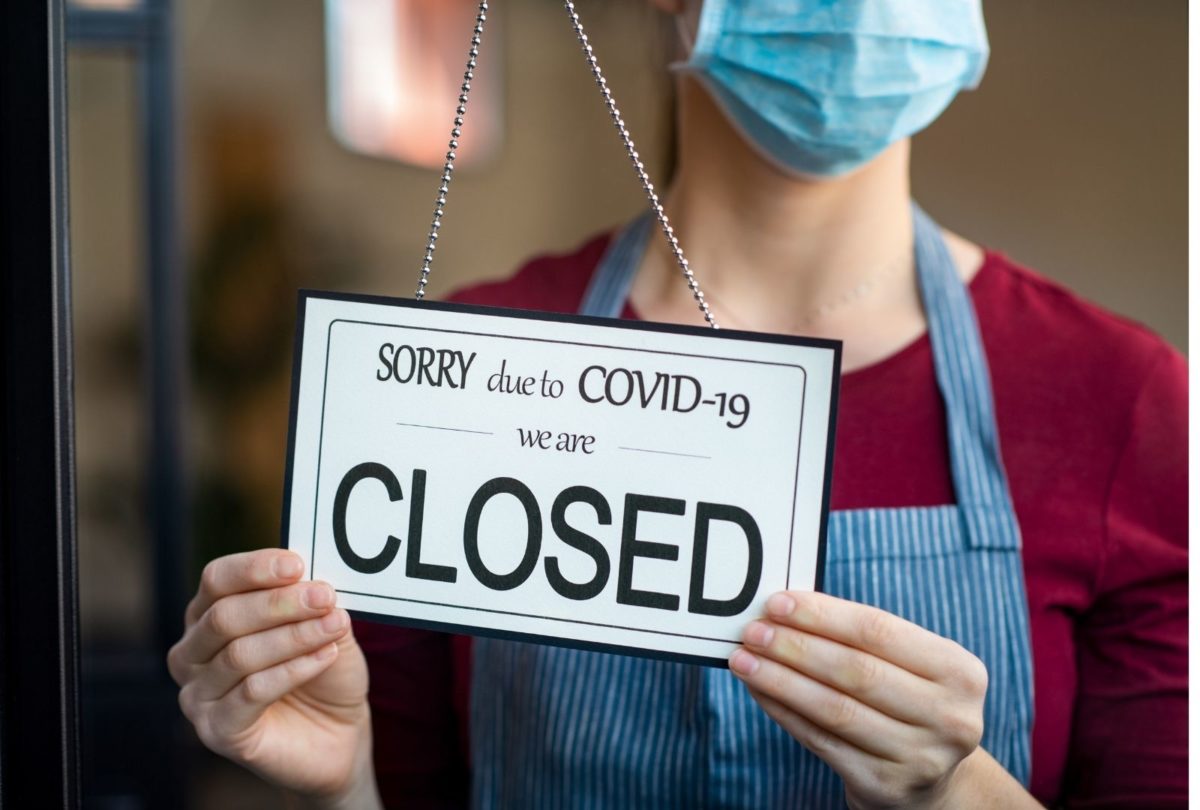

Is the Third Wave ‘Strike Three’ for Small Business?20210422181856

Is the Third Wave ‘Strike Three’ for Small Business?

As Canada finds itself immersed in the third Canadian wave of the COVID-19 pandemic, a multitude of businesses have been locked down again. There’s one pressing question on the minds of business owners everywhere: will Wave Three be Strike Three for small business? It will depend, says the experts. “For some businesses, COVID has provided […]...