Our integrated

wealth management

process begins

with a coffee.

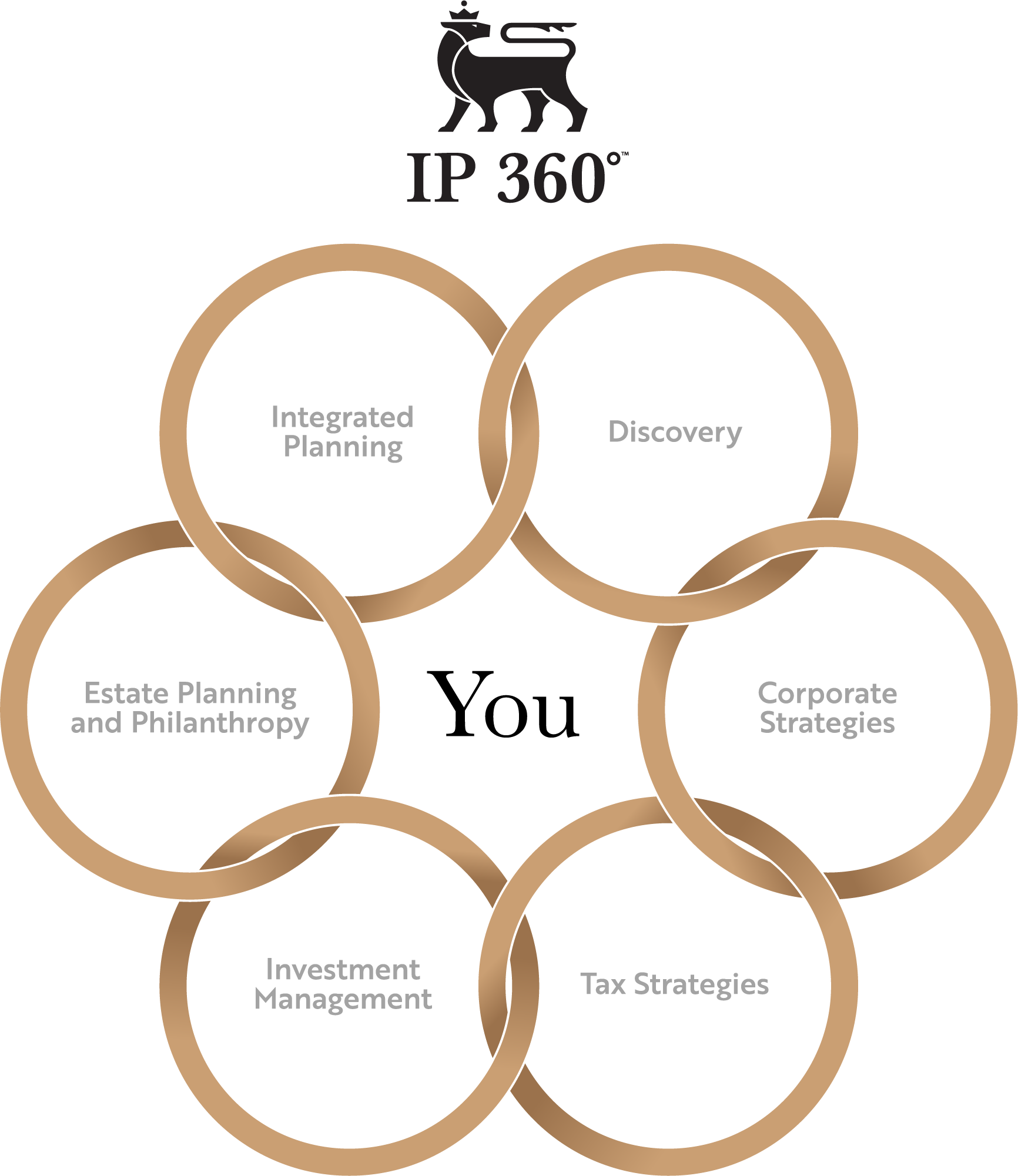

Imagine all your trusted advisors gathered around one table, with an expert leading the discussion and ensuring everyone understands your goals. That’s the IP 360°TM process.

IP 360°TM

Our Integrated Planning Solution

The IP 360°TM process is how we review and build each client’s wealth management plan and portfolio. We work with your trusted advisors and work cross- discipline to ensure all your experts are united through solid communication and common goals.

The IP 360°TM process puts a stop to:

- constant meetings at offices all over town,

- crossed wires between advisors, and

- the conflicting advice that can come from different experts.

We bring together your experts and our experts, and create a unified action plan using a round-table approach. Your goals and challenges are reviewed, and we coordinate everyone through the planning process. This ‘quarterback’ approach is key for our clients, making it easier to understand and take action on their financial, legal, and lifestyle goals.

We meet with you to gain a better understanding your goals and challenges. There are no cookie-cutter solutions here: our focus is on your financial goals, your risk appetite, your existing investments, and your lifestyle aspirations. We’ll review your existing situation in full detail to determine if there are any gaps. This is the first step of the IP 360°TM process and often the most time-consuming, but the pay-off is always worth it.

Depending on your economic landscape, this step can take many forms. We examine all aspects of your corporate affairs including corporate structures, legal agreements exit strategies; we ensure you’re on track for your future.

We apply an institutional approach to investing with a prudent and highly disciplined process to stock selection, asset allocation, and risk management.

We work with our clients and their tax professionals to create an estate and philanthropic plan that enriches your beneficiaries (family and charities) in the most tax-effective manner. Estate planning can be a minefield for mistakes that can derail the plan you worked so hard to create; we ensure you’ve got the expert strategy you need to feel assured your wishes will be honored and realized.

This is where our team puts it all together. Addressing each segment of IP 360°TM process, our financial planning process is robust, comprehensive, and pragmatic. We believe in crafting a financial roadmap that is sustainable, allowing for life’s twists and turns.

We empower our clients by helping them to understand the “why” behind their financial plan. We don’t just leave a client with advice, we are always there to help execute on our recommendations.

— Cassandra Rolph, Financial Planning Associate