Russia Invading Ukraine: An investor’s perspective20220224163738

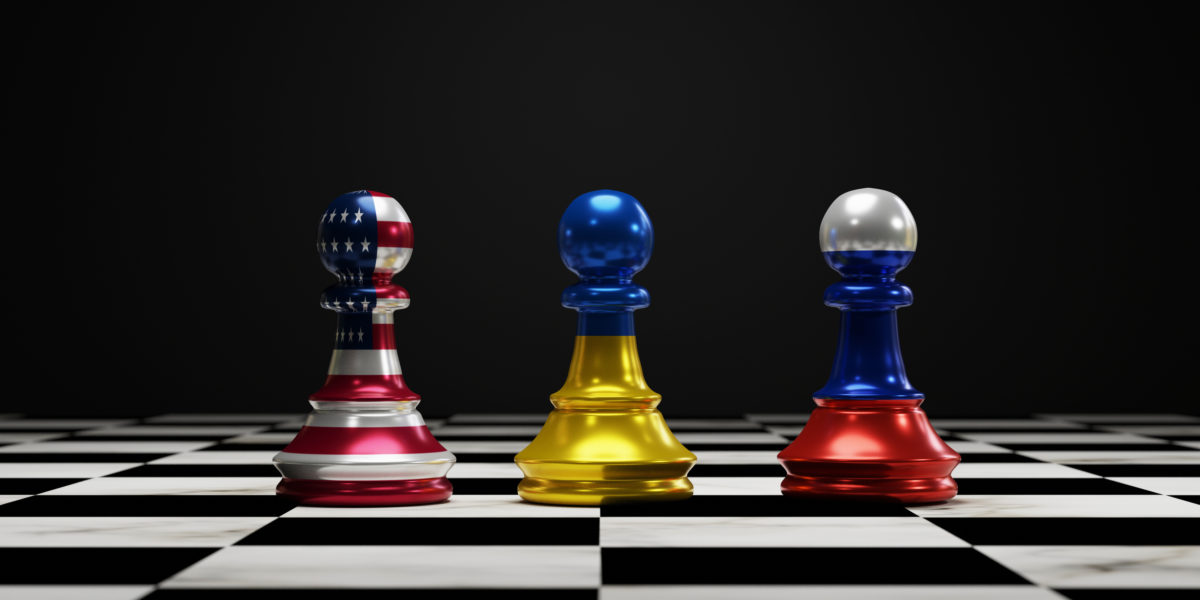

Russia Invading Ukraine: An investor’s perspective

Starting 2022 off with another crisis, we watch as Russia invades Ukraine and launches an aggressive military strike. Having to deal with COVID for the past two years, the world is now facing a new disease—the disease of aggression by the Russians. Sadly, there is no MRNA vaccine for this aggressive pathology, and we must […]...

Closing the Gender Wealth & Investing Gap20220222220228

Closing the Gender Wealth & Investing Gap

Even as women are becoming increasingly responsible for bringing in an equal (or greater) share of the household income, there’s lagging support in familiarizing women with investment strategies. And while a large number of Canadians are not truly financially literate, men often plunge ahead with investments and other financial strategies due to their statistically greater appetite for risk....

Is it time for financial doom and gloom? We think not.20220222172401

Is it time for financial doom and gloom? We think not.

First and foremost, we must remember that this is not the time to take a short-term view of the situation. Everything has a cycle—markets, economy, taxes, and politics. This is not the first time in history we’ve experienced similar cycles, and that means we can learn from history....

What is IP Private Wealth?20211221165246

What is IP Private Wealth?

December 21, 20210 comments

We’re glad you asked. IP Private Wealth is a wealth management firm that uses a family office philosophy to provide a truly in-depth and comprehensive approach to financial planning. We use the ‘family office’ model, which allows us to help clients through a myriad of financial and lifestyle decisions. Watch this video introduction to our […]...

What does the Custodian do for Me and My Wealth Management Firm?20210921154200

What does the Custodian do for Me and My Wealth Management Firm?

The difference between a custodian and an investment manager is confusing, but these two crucial entities work to grow and protect your wealth....

Entrepreneurial Advice from a 20-year veteran: Corinne Bryson, INEX Inc.20210721142326

Entrepreneurial Advice from a 20-year veteran: Corinne Bryson, INEX Inc.

Building a company from the ground up can be an equally risky and rewarding process for entrepreneurs. To learn more about what it takes to start a business, we sat down with Corinne Bryson, the founder and CEO of INEX Inc, an Ottawa-based business that creates emergency and end-of-life executor kits. Corinne shares many interesting […]...

IP360° Podcast Ep 12: Entrepreneurial lessons from Corinne Bryson, InEx Inc20210720220647

IP360° Podcast Ep 12: Entrepreneurial lessons from Corinne Bryson, InEx Inc

Corinne Bryson is founder and CEO of INEX Inc., a company devoted to creating executor packages and resources that are distributed through funeral homes. Corrine began her entrepreneurship journey 20 years ago and we asked her to join us on the IP360° Podcast to share lessons, stories, and warnings for the next wave of business […]...

Financial Planning Designations: Who does what, and who do I need?20210720202155

Financial Planning Designations: Who does what, and who do I need?

As if the financial planning and wealth management industry wasn’t already full of jargon, the certifications and designations behind advisors’ names simply add more confusion to the industry. These days there are numerous designations that advisors can get, but they don’t all add up to the same use or value for the client. Here are a few of the most common designations you’ll find in financial ad...

Investing 101: What are the various asset classes available to investors?20210520141116

Investing 101: What are the various asset classes available to investors?

When it comes to investing in public markets, most investors are familiar with the three traditional asset classes: Cash and Money Markets, Bonds, and Stocks. But there are other classes that may be overlooked, or that you may forget to discuss with your advisors when you meet to work on your portfolio strategy. Here’s a […]...

What should I do financially in my 30s?20210413184212

What should I do financially in my 30s?

The millennial is someone who was born anywhere between 1981 and 1996. Often the kids of hard-working baby boomers, they are usually ambitious, educated, self-confident, and technologically savvy. They often go against the conventional way of thinking or doing things, and tend to push the limits. Most importantly: they are up to 40 years old […]...