Starting 2022 off with another crisis, we watch as Russia invades Ukraine and launches an aggressive military strike. Having to deal with COVID for the past two years, the world is now facing a new disease—the disease of aggression by the Russians. Sadly, there is no MRNA vaccine for this aggressive pathology, and we must hope that it is not overly infectious to the point where Europe becomes infected.

Although Ukraine is not part of the North American Treaty Organization (‘NATO’) and has been denied access, Russia still feels threatened–for whatever reason–and has used disinformation to justify their invasion. NATO will ensure their member countries are secure and protected from any further Russian aggression.

How Russian energy works as the lynchpin

With all this uncertainty, the stock markets are selling off around the globe and energy prices have spiked on fears that energy from Russia may need to be cut off; and that means Europe and other regions, highly dependent on Russian oil and gas, will need to buy from other sources. Since Russia is the second largest exporter of energy in the world, they have utilized this position to build up their foreign currency reserves and military budgets to allow them to strategically invade a sovereign country.

Outside of energy, Russia does not have much of a globally competitive economy. So logically, sanctions on their energy sector are vital if western allies are to economically cripple them and their oligarchs.

What’s happening in the stock market

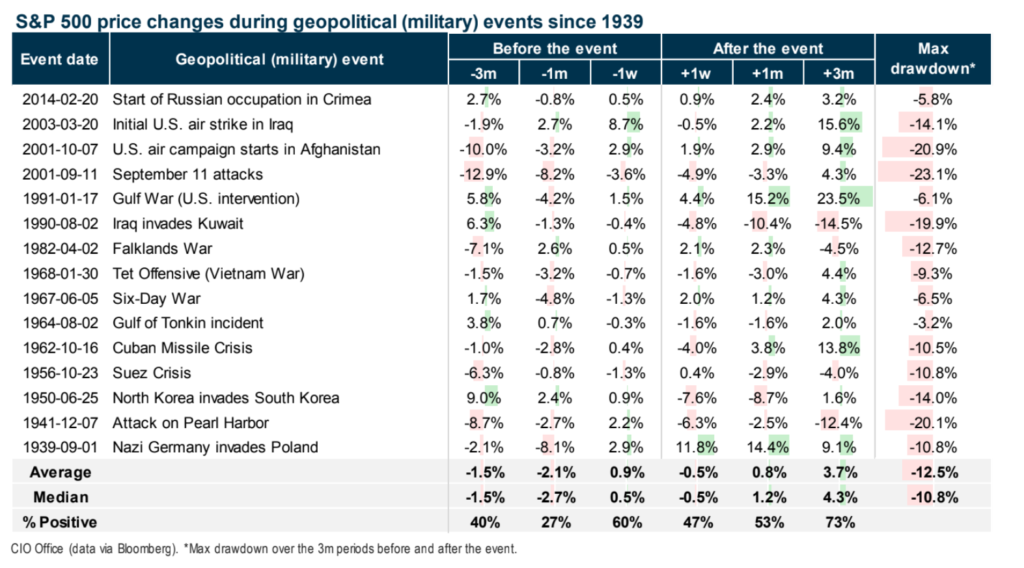

The stock market sell-off is an unfortunate consequence of uncertainty, but could be short lived given that Russian and Ukraine economies are not huge contributors to global domestic production. Still, the fears of an escalated conflict have put investors around the globe on edge.

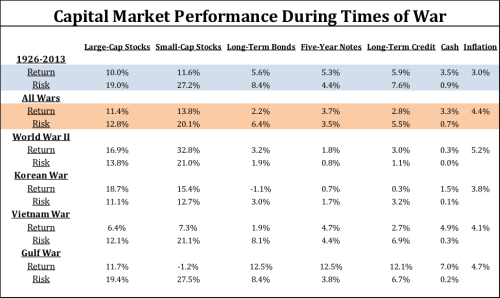

We have seen market sell-offs in the past and what follows in time is a market recovery.

What we recommend and foresee:

Our position here at IPIC/IPPW is not to panic, and we are holding off deploying the cash position in the portfolios. Our value strategy is not immune to market volatility; but we do believe that we should fare better than a strategy focused on expensive tech growth stocks that have been trading at unprecedented Price to Earnings multiples. Nasdaq has taken the brunt of the sell-off, not surprisingly, given that the index soared to overvalued levels in the past two years.

Panic selling and market timing will result in the following impact:

- For non-registered accounts, selling would crystalize any unrealized gains and taxes will have to be paid on the gains.

- Your account will lose the investment income during the time the portfolio sits in cash.

- Market Timing when to reinvest has proven to be extremely difficult given human anxiety lasts much longer than the markets return to positive.

Conclusion: strap in, and work with your advisors.

Investors should be strapping in for a bumpy ride and, and we expect all G7 countries to ensure their policies will adapt to the current uncertainty and mitigate any economic impact. As investment counsel, we are tracking every moment of this crisis politically, geographically, and economically.

On a human note, our thoughts and prayers are with the people of Ukraine and our clients with connections to this beautiful country.