First Home Savings Account: Understanding the basics20220823140714

First Home Savings Account: Understanding the basics

What is the First Home Savings Account? In April 2022, the Federal government introduced the “First Home Savings Account”, or FHSA. This new type of registered savings account officially launches in 2023 and will allow Canadians to save up to $40,000 towards their first home. The FHSA combines the features of the RRSP and TFSA, […]...

Financial Q&A: How do physicians prepare for being business owners?20220818135444

Financial Q&A: How do physicians prepare for being business owners?

Senior wealth advisor David Bourada talks about how physicians need to prepare for business ownership, and what is missing from their support network. IP Private Wealth provides 360° wealth management and financial planning for affluent Canadians of high net worth through a Family Office model....

Understanding your child’s RESP20220608161350

Understanding your child’s RESP

Hearing the word RESP is common around this time of year as your kids accept offers to university or college and begin preparations for the fall. We may understand that these savings plans are an effective way to save money and reduce the impacts of annual taxation, but how much do you really understand about the RESP process? Here’s a short guide to help you understand exactly what you’re purchas...

Achieving Financial Independence for Women: What Sets Us Back in 202220220422004909

Achieving Financial Independence for Women: What Sets Us Back in 2022

Financial independence: a term that has risen in popularity over the years and has come to mean something important to women worldwide. But what does it really look like, and who does it really matter to? What is Financial Independence? Simply stated, financial independence means three things: Control over your finances; The ability to support […]...

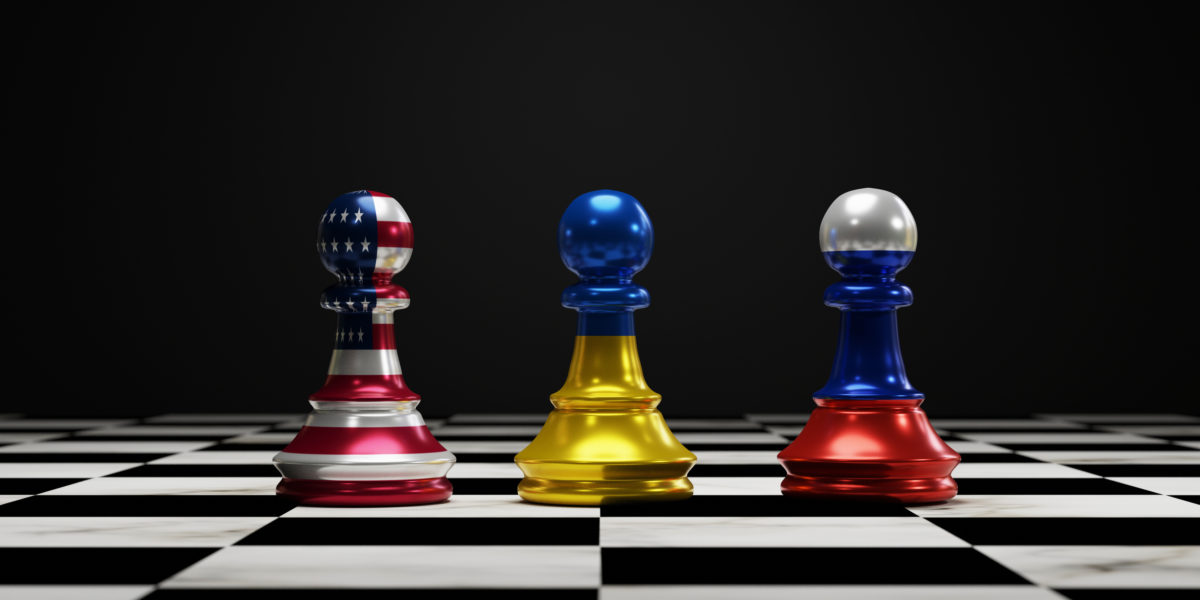

Russia Invading Ukraine: An investor’s perspective20220224163738

Russia Invading Ukraine: An investor’s perspective

Starting 2022 off with another crisis, we watch as Russia invades Ukraine and launches an aggressive military strike. Having to deal with COVID for the past two years, the world is now facing a new disease—the disease of aggression by the Russians. Sadly, there is no MRNA vaccine for this aggressive pathology, and we must […]...

Closing the Gender Wealth & Investing Gap20220222220228

Closing the Gender Wealth & Investing Gap

Even as women are becoming increasingly responsible for bringing in an equal (or greater) share of the household income, there’s lagging support in familiarizing women with investment strategies. And while a large number of Canadians are not truly financially literate, men often plunge ahead with investments and other financial strategies due to their statistically greater appetite for risk....

Is it time for financial doom and gloom? We think not.20220222172401

Is it time for financial doom and gloom? We think not.

First and foremost, we must remember that this is not the time to take a short-term view of the situation. Everything has a cycle—markets, economy, taxes, and politics. This is not the first time in history we’ve experienced similar cycles, and that means we can learn from history....

What is IP Private Wealth?20211221165246

What is IP Private Wealth?

December 21, 20210 comments

We’re glad you asked. IP Private Wealth is a wealth management firm that uses a family office philosophy to provide a truly in-depth and comprehensive approach to financial planning. We use the ‘family office’ model, which allows us to help clients through a myriad of financial and lifestyle decisions. Watch this video introduction to our […]...

Should I Pay Myself in Salary or Dividends?20211116182741

Should I Pay Myself in Salary or Dividends?

It comes up in every initial meeting we have with a business owner: the question of salary versus dividends. Both are legitimate ways to draw an income from your corporation, but both have their pros and cons. There’s 3 main ways to pay yourself as a business owner. When it comes to paying yourself from […]...

How doctors can protect their income in case of illness20211109215208

How doctors can protect their income in case of illness

You’ve likely invested over 10 years of your life and over $200,000 into your education on your path to becoming a physician—a career that requires your mind and body to be in sound working order. Breaking a couple fingers on a soccer pitch or getting a concussion on an ATV may be moderate inconveniences to the average person, but to a doctor, the wrong injury at the wrong time can end a career....